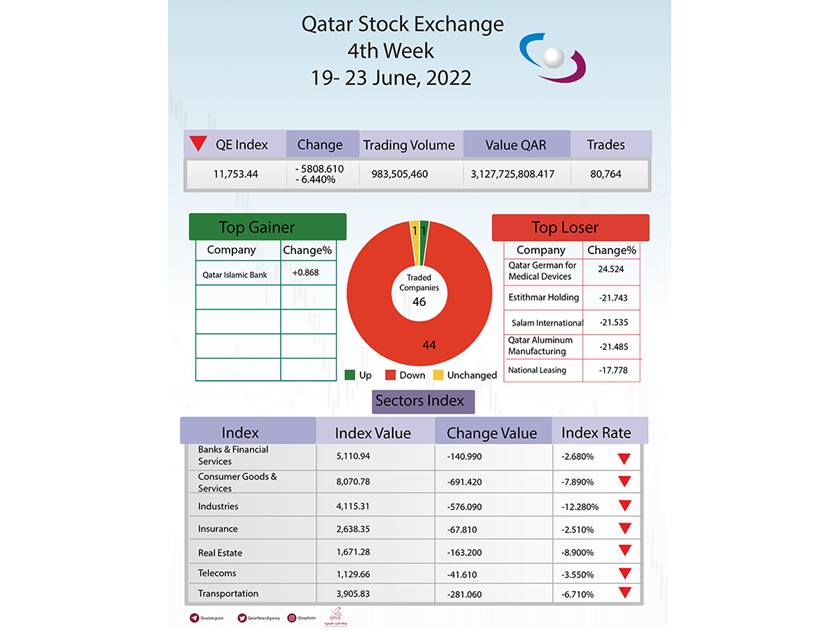

Doha, June 23 (QNA) - Qatar Stock Exchange (QSE) index continued its decline for the second week in a row, to fall below 12,000 points, breaking the support point of 12,500 points, to lose 808.610 points in the fourth week of this June, by 6.440 percent, and fall to 11,753 points.

In a statement to Qatar News Agency (QNA), the financial analyst Tamer Hassan attributed the decline recorded in Qatar Stock Exchange index in its weekly dealings to the pressures imposed by the rise in interest rates on the Qatari market with the accompanying sales of local portfolios, in addition to the negative effects of the Russian-Ukrainian war and the repercussions of the recession which pushes oil prices to decline.

He said that the continuation of raising the interest rate by the US Federal Reserve confused the financial markets and is expected to further deepen the losses of the stock exchanges regionally and internationally.

The weekly report of the Qatar Stock Exchange indicated a decline in the market value at the end of the week's trading to reach QR 659.723 billion, compared to its level last week of QR 705.803 billion, a decrease of 6.52 percent.

Hassan expected that Qatar Stock Exchange index would witness positive movement in the coming period, supported by the solidity of the Qatari economy, which is expected to achieve growth rates of 4.9 percent this year, and the measures taken by the government by further opening the capital of a number of Qatari companies to foreign investment by up to 100 percent, as well as pushing from the semi-annual results of the listed companies, many of which will exceed expectations.

In this context, he added, that these elements will restore QSE index to its glow in the near term.

The report pointed out that the value of stock trading during the week ending today amounted to QR 3.127 billion, through the sale of 983.505 million shares, executed by concluding 80,764 transactions.

To conclude his analysis, Hassan said that despite the decline in Qatar Stock Exchange index during the last period, a positive movement witnessed by foreign portfolios through the increase in purchases of Qatari shares, in translation of their confidence in the Qatari economy and behind it its institutional fabric, adding, that the decision to raise the percentage of foreign ownership contributed by 100 percent in attracting about USD 12 billion since the beginning of the year. (QNA)

23 June 2022

Financial Analyst to QNA: Growth of Economy and Increase in Foreign Ownership will Restore QSE Index

Local

Keywords

Economy, Qatar

News Bulletins

Most Read