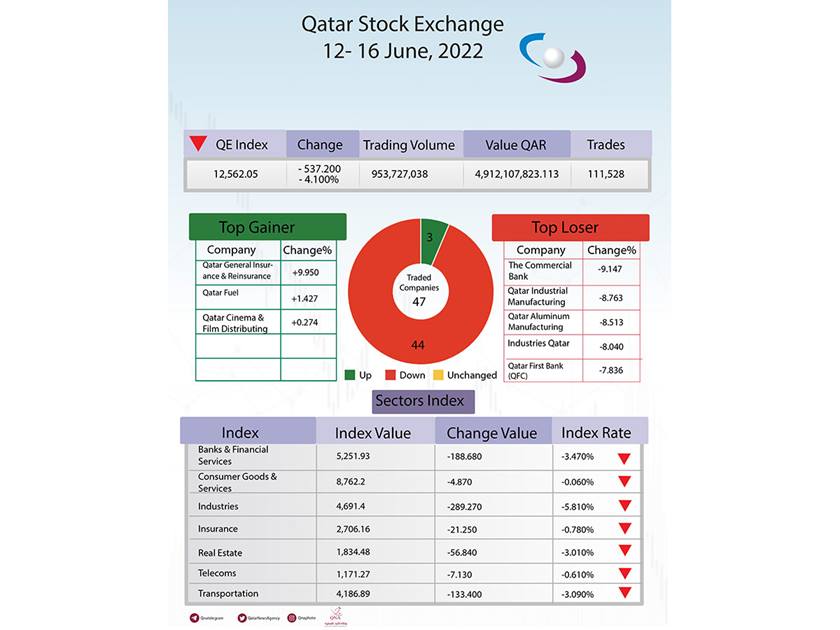

Doha, June 16 (QNA) - Qatar Stock Exchange (QSE) index lost 537.2 points from its balance at the end of trading in the third week of June, with a decline of 4.1 percent, to reach the level of 13.12,562 points, in a corrective movement that characterized various global and regional markets in the recent period.

The financial analyst, Ramzi Qasmieh, confirmed in a statement to Qatar News Agency (QNA) that the closing of Qatar Stock Exchange index at the level of 12562 points, confirms its cohesion at its support point, which is 12500 points, despite its decline below those levels at the beginning of the transactions of the last session of this week, to re-rise to levels lockout.

The term support refers to the point below which the index is very difficult to fall, that is, in the path of its continuous decline, it reaches a certain point, but it immediately falls back to rise again, and thus this point is called the point of support.

Qasmieh said that the decline in Qatar Stock Exchange index at the end of the week coincided with some important events such as raising interest rates and the accompanying instability in global and regional markets until the impact of the decision is absorbed, as well as the application of the results of the semi-annual FTSE review that coincided with trading the end of the week, which had an impact on the level of liquidity, which amounted to QR 2.4 billion on the last day of trading.

Qasmieh indicated that by the end of the week, Qatar index will lose 4.1 percent of its value in a corrective movement, similar to what the financial markets are witnessing in the world and the region.

The weekly report of Qatar Stock Exchange indicated a decline in the market value at the end of trading of the week to reach QR 705.803 billion, compared to its level last week of QR 732.281 billion, a decrease of 3.61 percent.

The financial analyst pointed out that the direct results of FTSE review had a clear impact on the banks, as the weights of three major banks were increased, while the weights were marginally reduced on some companies such as Qatar National Bank and Industries Qatar.

The report indicated that the value of stock trading during the week ending today amounted to QR 4.912 billion, through the sale of 953.727 million shares, executed by concluding 111,528 deals.

To conclude his weekly reading of the stock market index, he said that the decline was fundamentally evident in the banking sector, as it fell by about 3.5 percent, which constitutes the largest weight of the listed companies by 55 percent, in addition to the pressures of the industry sector, which fell by about 6 percent, driven by QAMCO shares.

He pointed out that the best performance was for Qatar General Insurance and WOQOD shares, on the other hand, Commercial Bank and QAMCO, the least performing share. (QNA)

16 June 2022

Financial Analyst to QNA: QSE Index Maintains its Support Point, and FTSE Review has Supported the Market's Liquidity

Local

Keywords

Economy, Qatar

News Bulletins

Most Read